Nixing the Pension Perks: A Call for Fiscal Responsibility in New York

As spring approaches, New York’s lawmakers prepare to unleash yet another series of pension enhancements that cater to public employees. This ritual, driven by the imperatives of powerful unions, challenges the very tenets of fiscal responsibility. Governor Kathy Hochul recently vetoed one such measure, but she faces eleven more bills that demand a similar fate. The time is ripe for a deeper reflection on the costs borne by taxpayers and the sustainability of our public finances.

The ongoing pension debate in New York requires careful consideration of long-term financial impacts.

The ongoing pension debate in New York requires careful consideration of long-term financial impacts.

The Costs of Pension Sweeteners

Public employee pension sweeteners, those often seemingly innocuous enhancements, are now core contributors to a growing financial burden on New York’s public sector. The Citizens Budget Commission has indicated a troubling trend: between 2014 and 2019, only 25% of flagged sweeteners were vetoed, while from 2021 to 2023, that rate rose alarmingly to 48%. This statistic underscores a crucial turning point for Governor Hochul — she must act decisively to reverse this trend.

The stakes are high. The current eleven bills under review threaten to impose an immediate cost of at least $19.8 million to taxpayers, growing into a staggering $103 million annually in the years to come. Remarkably, four of these bills initially lacked required fiscal-impact estimates, suggesting that their implications could be even worse than anticipated.

As soaring pension costs continue to slice into local governments’ budgets, the ripple effect restricts their capacity to provide essential government services. This often leads to undesirable tax hikes, a burden that legislators, shielded from financial repercussions, seem to view as nothing more than a series of free lunches.

The Legislative Landscape

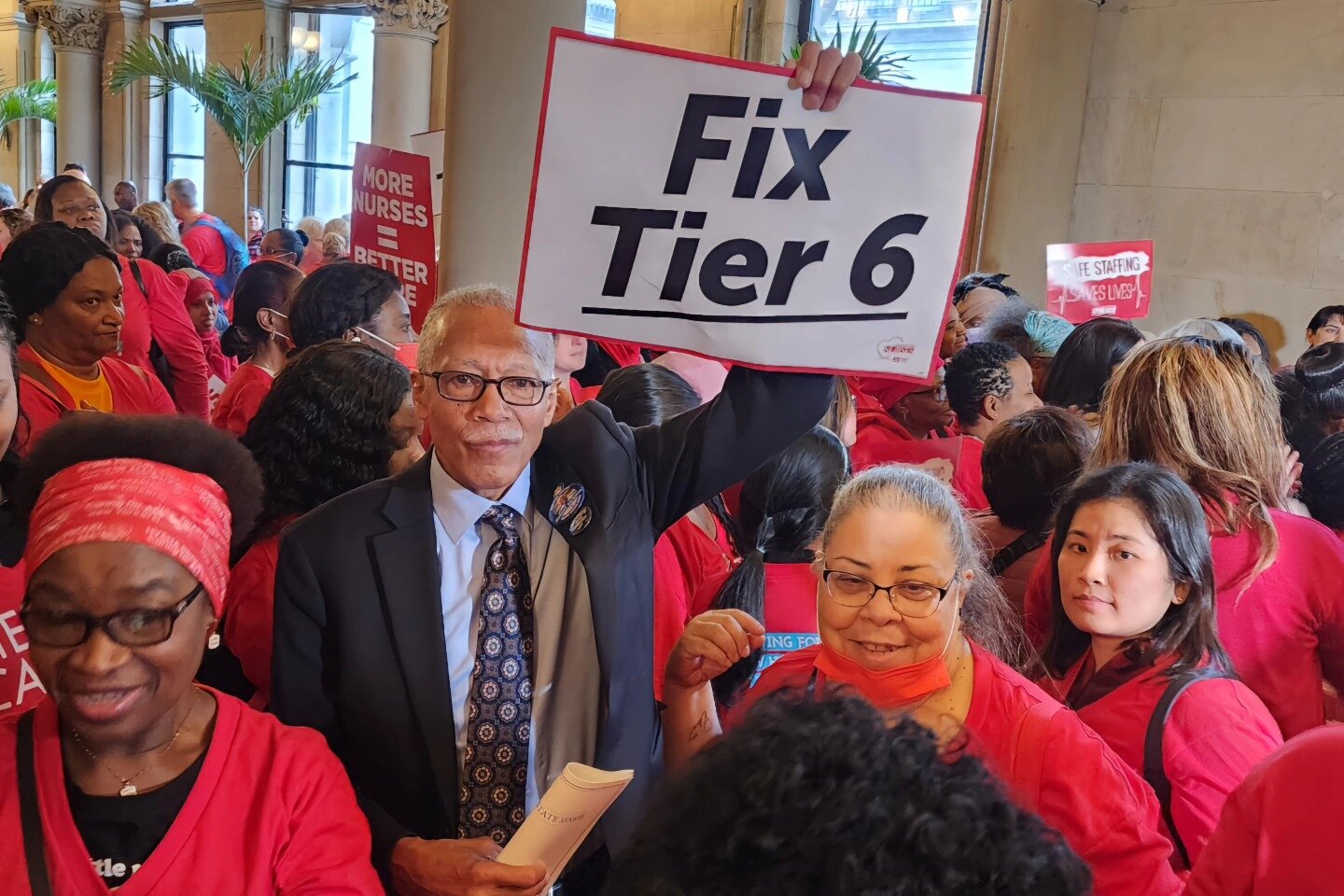

The troubling behavior of the legislature was recently exemplified by a move that shifted $438 million annually in pension costs to state and local governments. This rollback of the Tier 6 reforms shines a light on the increasing pressures in New York’s fiscal landscape. Proposals circulating that would potentially exacerbate these financial pressures could add as much as $1.5 billion to yearly costs — all of which fall upon the shoulders of taxpayers.

It’s worth considering why this pattern persists. Legislative decisions appear increasingly detached from economic realities, with unions perpetually returning to the table for negotiations that lead to even more generous packages. Under scrutiny, it becomes evident that the dynamics in Albany are more of an insular game played behind closed doors than a well-thought-out approach to public service remuneration.

A visual representation of how pension sweeteners affect the state budget and local government services.

A visual representation of how pension sweeteners affect the state budget and local government services.

Reversing the Trend

For Governor Hochul, the opportunity to redefine this narrative lies starkly before her. She must acknowledge that to address the exodus of residents from the Empire State, she needs to rigorously scrutinize every proposal that enhances pension benefits. Each veto is a statement of intent to restore fiscal sanity. Hochul’s commitment to accountability and responsible governance must translate into actionable decisions—not just rhetorical assurances.

By taking a hard stance against unsustainable pension enhancements, Hochul can initiate a critical conversation about how New York manages its public employee costs. The decisions made in Albany influence not only current fiscal health but also the future livability of New York State — a notion that should not be taken lightly.

The Path Forward

In summary, vetoing unnecessary pension sweeteners is not merely a budgetary necessity; it’s an ethical obligation to the citizens of New York. As the ongoing debate around public employee compensation rages on, the call for transparency and accountability grows louder.

Any attempts to enhance pension benefits should begin with a comprehensive assessment of their long-term implications, not just a knee-jerk reaction to union lobbying or political pressure. Governor Hochul has the chance to make a difference by ensuring that every decision contributes positively to New York’s financial wellbeing.

Let’s ensure that, as stewards of public resources, we prioritize sustainable practices over short-lived gains. The road to economic stability starts with sound policymaking, and Hochul’s actions could very well set the precedent for future governors—one that favors fiscal prudence over political expediency.

Good governance is essential for a sustainable future, focusing on responsible budget management and transparency.

Good governance is essential for a sustainable future, focusing on responsible budget management and transparency.

As New Yorkers advocate for a livelier, more prosperous state, they deserve leaders who prioritize long-term viability over ephemeral rewards. It’s time for decisive action, and the clock is ticking for Governor Hochul to demonstrate her commitment to fiscal prudence.